osceola county property tax rate

Osceola County Property Appraiser Katrina S. Welcome to Osceola County Iowa.

Property Tax Search Taxsys Osceola County Tax Collector

First Half of Taxes DUE Septmeber 1st.

. My team and I love connecting with the community and look forward to future parades. Property Appraisers Office 2505 E Irlo Bronson Memorial Hwy Kissimmee FL 34744. The median property tax also known as real estate tax in Osceola County is 114800 per year based on a median home value of 10110000 and a median effective property tax rate of 114 of property value.

Search Use the search critera below to begin searching for your record. Osceola County Courthouse 300 7th Street Sibley Iowa 51249 712 754-2241. Economic Development Commission 300 7th Street Sibley Iowa 51249 712 754-2523.

407-742-4009 Local BusinessTourist Tax BRUCE VICKERS CFC CFBTO ELC. OSCEOLA COUNTY TAX COLLECTOR. A propertys value rises to 95 when it is acquired.

407-742-4037 Property Taxes FAX. Welcome to the Delinquent Tax Online Payment Service. The median property tax on a 19920000 house is 209160 in the United States.

Osceola County has relatively high median property taxes with the property tax being around 095 of the propertys assessed fair market value. We enjoyed seeing everyone at the Silver Spurs Rodeo Parade in downtown City of St. If you need access to property records deeds or other services the Osceola County Assessors Office cant provide you can try contacting the Osceola County municipal government.

Overview of Osceola County FL Property Taxes. Cloud Florida a couple of weeks ago. Scarborough CFA CCF MCF March 8 2022 507 pm.

What is the due date for paying property taxes in Osceola county. If you dont pay by the due date you will be charged a penalty and interest. The median property tax on a 19920000 house is 189240 in Osceola County.

Tonia Hartline 301 W. Irlo Bronson Memorial. OSCEOLA COUNTY TAX COLLECTOR.

A median effective property tax rate of 0 is assigned as well as one of no taxable value. In-depth Osceola County FL Property Tax Information Assess all the factors that determine a propertys taxes with a detailed report like the sample below. Osceola Tax Collector Website.

Under Florida law e-mail addresses are public records. Discover Mastercard Visa and e-Check are accepted for Internet Transactions. Irlo Bronson Memorial Hwy.

Create a free account and review your selected propertys tax rates value assessments and more. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email. 407-742-3995 Driver License Tag FAX.

Put another way if you live in Osceola County you can expect to pay 1210 for every 1000 of real estate value or 121. The Osceola County seat can be found in the County Courthouse in Sibley. Property taxes are due on September 1.

The median home value for New York City is 199200 so it would cost 500000 per year. 4730 south orange blossom trail. OSCEOLA COUNTY TAX COLLECTOR.

The median property tax on a 19920000 house is 193224 in Florida. Irlo Bronson Memorial Hwy. This service allows you to search for a specific record within the Delinquent Tax database.

When paying property taxes by parcel number please enter the 10 digit parcel number which appears in the bottom right corner of. If Osceola County property taxes are too high for your revenue resulting in delinquent property tax payments you can take a quick property tax loan from lenders in Osceola County FL to save your property from a looming foreclosure. At the same time Osceola County residents paid 1887 in property taxes also known as real estate taxes.

Osceola county collects on average 095 of a propertys assessed fair market value as property tax. If you do not want your e-mail address released in response to a public records request do not send electronic mail to this entity. It is the responsibility of each taxpayer to ensure that hisher taxes are paid and that a tax bill is received.

Pay Property taxes in Osceola County Florida with this online service. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email Cart. Please correct the errors and try again.

Enjoy online payment options for your convenience. Compared to the state average of 121 homeowners pay an average of 000 more. Search all services we offer.

Welcome to the osceola county treasurers web page. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar. We provide the following services from our office.

The Tax Collectors Office provides the following services. Out of the 67 counties in Florida Osceola County has the 5th highest property tax rate. Ad Valorem taxes on real property are collected by the Tax Collector on an annual basis collection begins on November 1st for the current year January through December.

On average Osceola County residents pay about 348 of their yearly income on their property tax. Osceola County Florida Property Search.

![]()

Osceola County St Cloud Propose Smaller 2021 22 Budgets Osceola News Gazette

Osceola County Property Appraiser How To Check Your Property S Value

Osceola County Fl Property Tax Search And Records Propertyshark

I Believe Orlando Is In Orange Osceola County Map Of Florida Map Of Florida Cities Florida

Osceola County Fl Property Tax Search And Records Propertyshark

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Celebration Fl Lake Garden

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Celebration Fl Lake Garden

Free Credit Report Offers Extended Complaints Have Increased Florida Realtors In 2021 Credit Score Check Credit Score Better Credit Score

School Board Meeting Agenda Packet Osceola County

Distrito Escolar Del Osceola County School District

Osceola County Property Appraiser How To Check Your Property S Value

Agenda Tuesday March 15 2011 Osceola County School District

Focus Parent Portal Letter School District Of Osceola County

Osceola County Fl Property Tax Search And Records Propertyshark

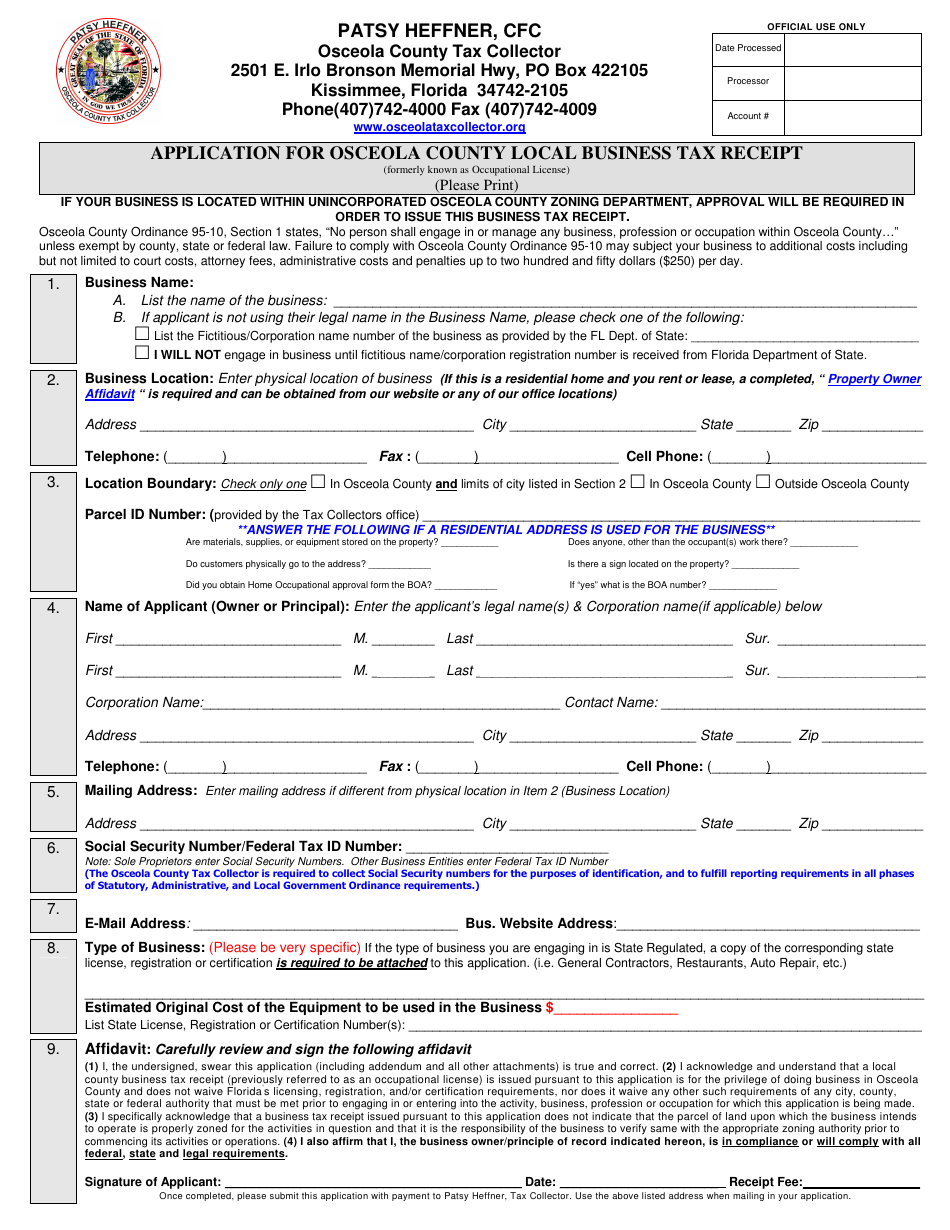

Osceola County Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

Osceola County Fl Property Tax Search And Records Propertyshark